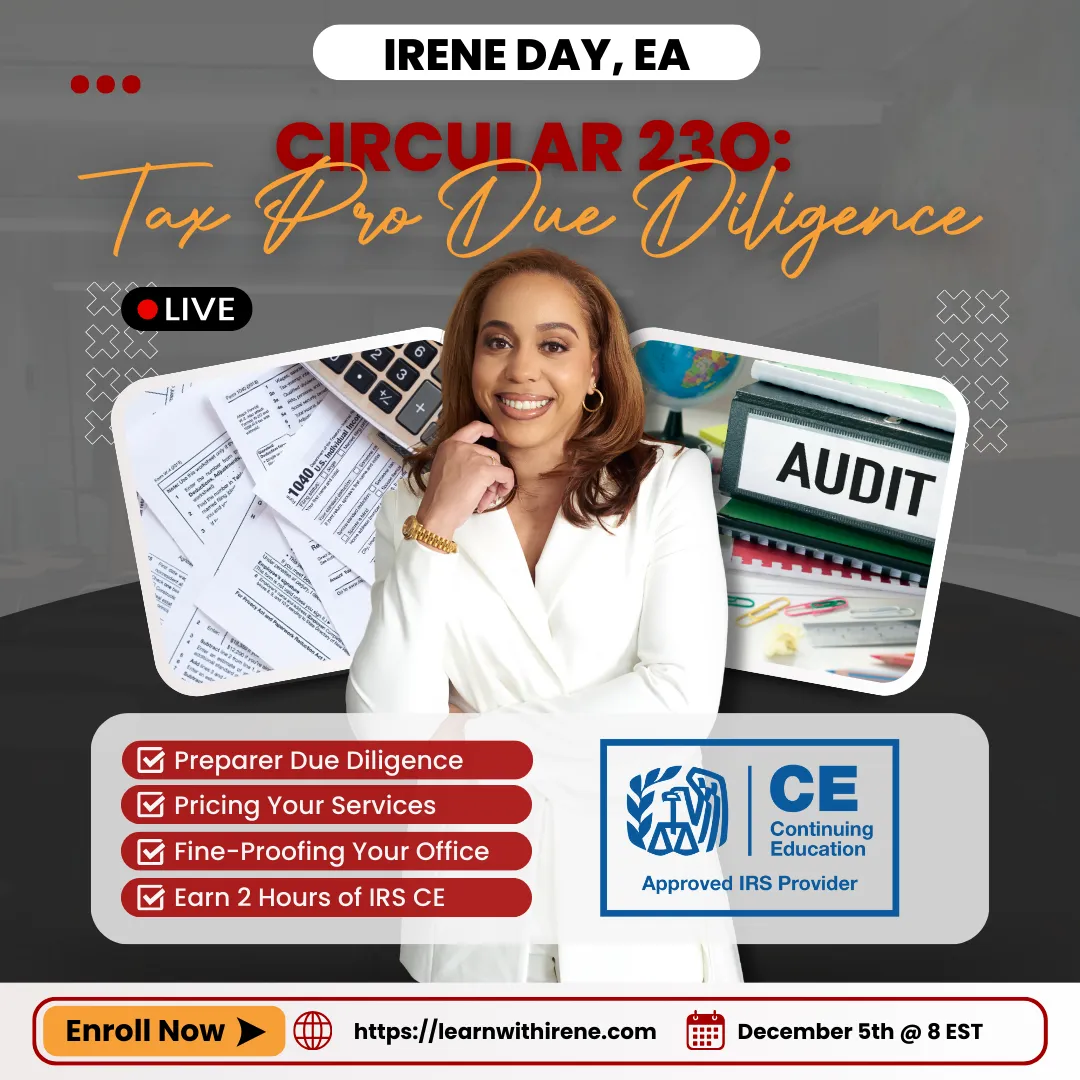

Circular 230: Tax Pro Due Diligence

When: December 19th

Time: 7pm EST

Where: Zoom (you will )

What I'll Be Covering:

✅ Your due diligence as a tax preparer

✅ Pricing your services to not run into an issue with the IRS

✅ The documents you need to be collecting from your clients and the questions you need to be asking to meet your due diligence as a paid preparer

✅ What to do in case of a preparer audit

What You'll Receive:

✅ Live training with an Enrolled Agent and IRS Continuing Education Provider

✅ Live Q&A after class

✅ 2 Hours of IRS CE in Ethics